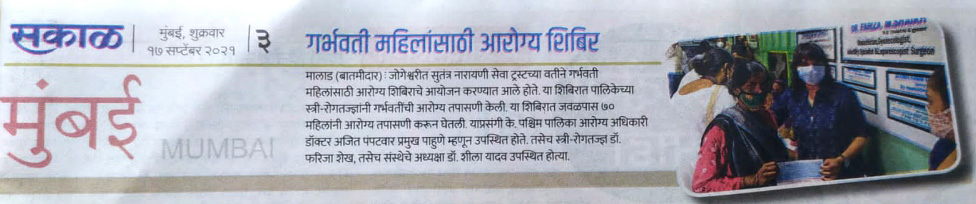

Sutantra Narayani Seva Trust is a Mumbai based registered Non-Government and Non-Profit making organization, established to work in the areas of Health, Education, relief of poor, empowerment to every citizen and to provide amenities and facilities to those who can’t afford.

Sutantra Narayani Seva Trust was founded in 2021 to support the efforts in achieving economic equality and sustainable development; healthcare services to the poor sick, the most neglected of aur society and improvement in the lives of marginalized sections of society.

Sutantra Narayani Seva Trust has been helping children and women from urban slums and other vulnerable communities to move on in life with the means of

providing education and healthcare facilities. Sutantra Narayani Seva Trust believes in providing all the resources to the needy people to support & direct them for livelihood in a leading way; by educating & empowering them to help write their own destiny.

Vision

To work towards creating a betterlndia providing services in education, health, empowerment and focus on humanitarian development.

Mission

To develop a relationship that make a positive difference in the lives of our beneficiaries. To provide comprehensive services and care that, together, deliver happiness to our beneficiaries.

Values

Encourage people for their development Reward people for their performance. Serve the mankind for the betterment of their lives.

Personal Accountability

Sutantra Narayani Seva Trust is a Registered trust under Indian Trust Act, E-12161/Thane, Dt. 14.01.2021

Sutantra Narayani Seva Trust is a registered trust under section 12 AA of Income Tax Act 1961. The income is calculated according to Section 11.

Yes. Donation Given to Sutantra Narayani Seva Trust is eligible for tax benefit under Sec 80G of Income tax Act.

Donation not only makes you cheerful, but it also allows you to contribute while saving taxes. Section 80G of the Income Tax Act of 1961 exempts both the charitable trust and the charity contributor from paying taxes, providing the NGO follows all of the act’s stated conditions. You must provide the contribution receipt in order to claim the deduction.

The maximum deduction is determined on the kind of donation. While there is no maximum limit specified for the deduction in certain situations, the income tax exemption under 80G is fixed at a limit of 10% of the charity donor’s adjusted gross total income in others.

Bank Details

Bank Name: HDFC Bank

Bank Branch: Jogeshwari (West)

Account Number: 50200057268843

IFSC: HDFC0000455

Pan No: ABBTS2004C

Phone Pay: 9930131839

All the donations to SN Seva Trust are tax exempted under 80G of the Indian Income Tax Act.